VIX Soars: Is This Volatility A Buy Signal Or A Red Flag?

The Volatility Index, also known as the VIX, is a widely followed indicator that measures the expected volatility of the S&P 500 stock market index. It is calculated by the Chicago Mercantile Exchange (CME) and is considered a benchmark for market uncertainty. When the VIX rises, it signals that investors are becoming increasingly uncertain about the market's direction, leading to increased trading activity and higher volatility. In recent months, the VIX has surged to new heights, sparking intense debate among market analysts and investors about whether this volatility is a buy signal or a red flag.

VIX levels above 30 are considered high, indicating increased market uncertainty and volatility. This is because when the VIX rises above 30, it typically signals that investors are becoming increasingly risk-averse, leading to increased selling pressure and reduced market participation. Conversely, when the VIX falls below 20, it can indicate a market that is oversold and due for a rebound. However, it's essential to note that the VIX is not a perfect indicator, and its accuracy can be influenced by various market and economic factors.

Understanding the VIX

The VIX is a statistical model that uses options data to estimate the expected volatility of the S&P 500. The model takes into account various factors, including the price of S&P 500 index options, the price of volatility-based options, and the relationship between these two sets of prices. The resulting VIX value is a weighted average of these inputs, providing a measure of the market's expected volatility.

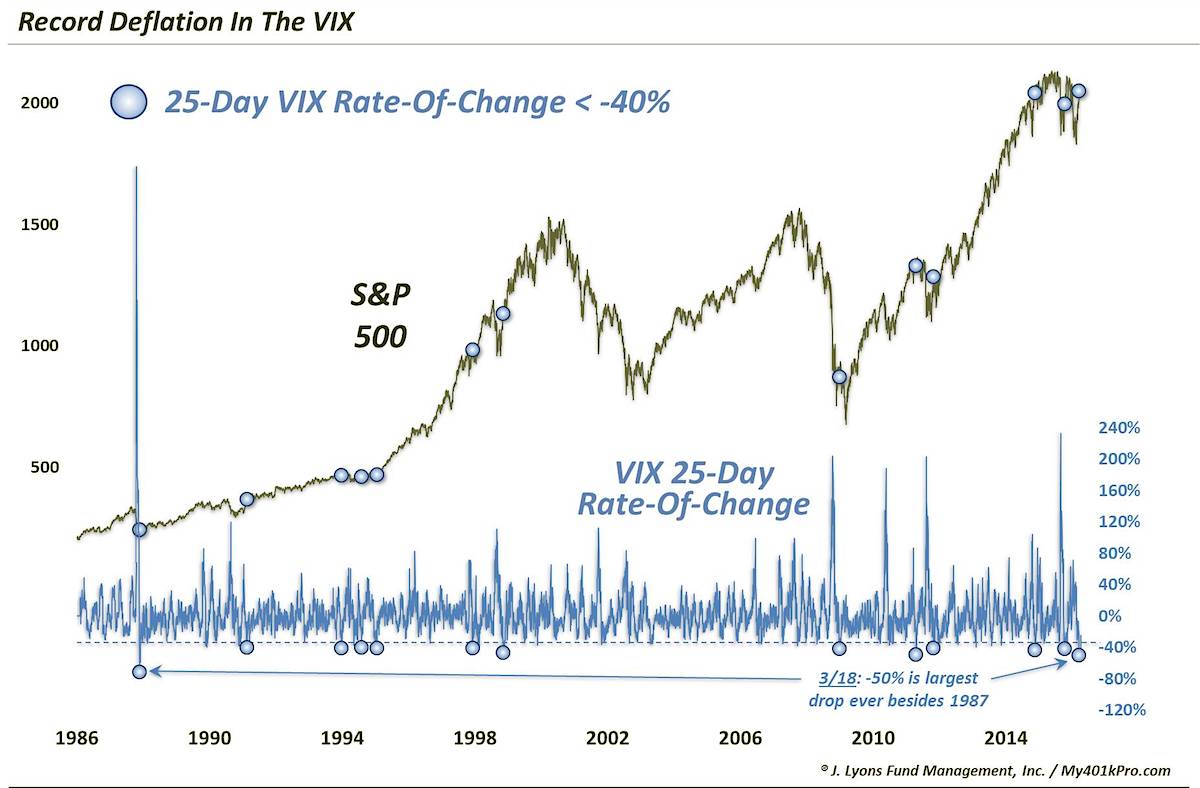

The VIX has undergone significant changes over the years, influenced by various market and economic factors. For example, the VIX increased dramatically during the 2008 financial crisis, as investors became increasingly risk-averse. In contrast, the VIX fell significantly in the early 2000s, as investors became more optimistic about the market's prospects. This highlights the importance of understanding the VIX in the context of market conditions and economic trends.

How to Read the VIX

When analyzing the VIX, it's essential to consider its historical context and the current market environment. A high VIX reading can indicate increased market uncertainty, but it's not a guarantee of market downturn. Conversely, a low VIX reading can indicate a market that is oversold, but it's not a guarantee of a market rebound.

Some common VIX readings and their implications are:

- VIX below 20: A low VIX reading can indicate a market that is oversold and due for a rebound.

- VIX between 20-30: A moderate VIX reading can indicate a market that is neutral, with some uncertainty but also opportunities for long-term investment.

- VIX above 30: A high VIX reading can indicate increased market uncertainty and volatility, making it more challenging for investors to predict market direction.

VIX vs. Historical Volatility

The VIX is often compared to historical volatility, which measures the actual price movements of the S&P 500 over a specific period. While historical volatility provides insight into past market performance, the VIX offers a forward-looking perspective on market uncertainty.

Historical volatility is typically measured using the standard deviation of returns over a specific period, such as a year or a quarter. In contrast, the VIX uses options data to estimate expected volatility, providing a more forward-looking picture of market uncertainty.

VIX vs. Other Volatility Metrics

The VIX is often compared to other volatility metrics, such as the CBOE Volatility Index (VIX II) and the Chicago Board Options Exchange (CBOE) Volatility Index (CBOEV). While these metrics are similar to the VIX, they have some key differences.

The VIX II is a volatility index that measures the expected volatility of the S&P 500 options market, rather than the overall market. This can make it more sensitive to market conditions and less useful for broader market analysis.

The CBOEV is a volatility index that measures the average volatility of the S&P 500 options market over a specific period. This can provide a more comprehensive picture of market volatility, but it may be less sensitive to short-term market movements.

VIX and Asset Allocation

The VIX can have significant implications for asset allocation decisions. A high VIX reading can lead investors to become more risk-averse, shifting their portfolios towards more conservative assets, such as bonds or cash.

Conversely, a low VIX reading can lead investors to become more optimistic, shifting their portfolios towards more aggressive assets, such as stocks or commodities. However, it's essential to consider the broader market environment and economic trends when making asset allocation decisions.

VIX and Derivatives Trading

The VIX is closely watched by derivatives traders, who use it to manage risk and profit from market volatility. Traders can use options contracts, futures contracts, or other derivatives to bet on market movements and volatility.

However, trading on the VIX can be challenging, as it's a non-standardized index with a complex underlying model. Investors should be aware of the risks and potential pitfalls of trading on the VIX, including high transaction costs and potential for significant losses.

VIX and Index Funds

Index funds are popular investment vehicles that track the performance of a specific market index, such as the S&P 500. The VIX can have implications for index fund performance, particularly if the fund is designed to provide volatility exposure.

Some index funds, such as those that track the VIX index, are designed to provide exposure to market volatility. These funds can be attractive to investors seeking to profit from market movements, but they typically come with higher fees and increased risk.

VIX and ETFs

Exchange-traded funds (ETFs) are a popular investment vehicle that allow investors to track a specific market index

Chaun Woo Real Parents Picture

Is Annaawai Married

Cinemas 2021

Article Recommendations

- Billytranger Things

- Meg Turney

- Diddy And Beyonce

- Janiceejanice

- Sophia Rain

- Joecarborough Illness 2024

- Hisashi Ouchi Po

- Benicioel Toro

- Jackoherty Girlfriend

- Danpilo