Nasdaq 100 Enters Correction As Tech Selloff Accelerates: Expert Analysis

The Nasdaq 100, a leading stock market index representing the 100 largest non-financial companies listed on the Nasdaq stock exchange, has entered a correction phase as the tech sector continues to bear the brunt of the selling pressure. The index, which is heavily weighted towards technology stocks, has been under intense scrutiny from investors and analysts in recent weeks due to concerns over inflation, interest rates, and the ongoing impact of the COVID-19 pandemic.

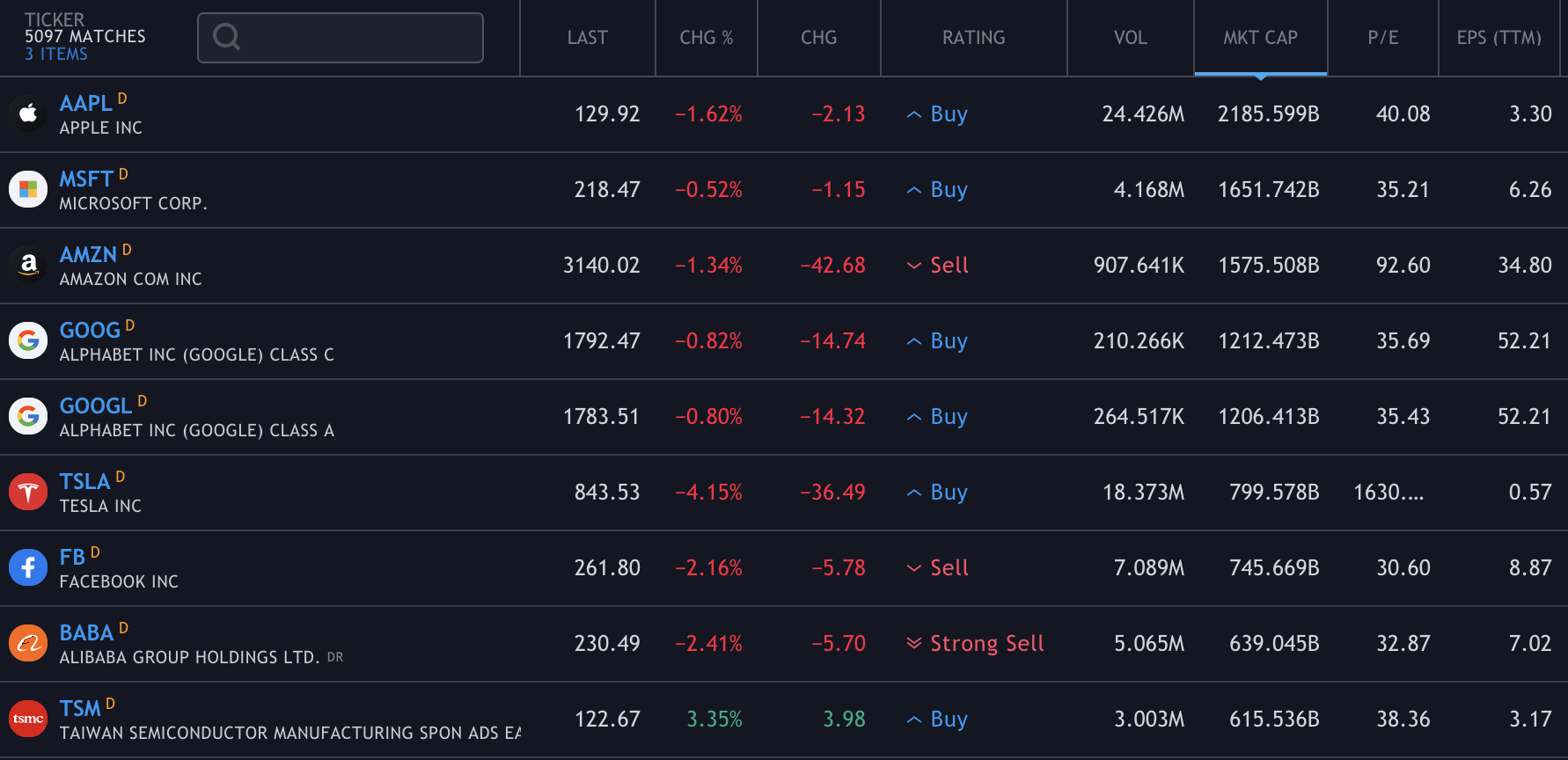

As the tech sector continues to slump, the Nasdaq 100 has fallen by over 10% in the past month, with some of the largest tech stocks including Apple, Amazon, and Google facing significant selling pressure. The decline has sparked concerns among investors about the potential for a broader market correction, and has prompted many to reevaluate their investment strategies.

In this article, we will delve into the reasons behind the Nasdaq 100's correction, and examine the potential implications for the broader market. We will also provide expert analysis from industry experts and conduct a detailed examination of the underlying factors driving the tech sector's decline.

Causes of the Nasdaq 100 Correction

Several factors have contributed to the Nasdaq 100's correction, including:

- Inflation concerns: Rising inflation has led to increased interest rates, which has made borrowing more expensive for companies and consumers alike. This has resulted in a decline in stock prices, particularly for tech companies that rely heavily on debt to fund their operations.

- Interest rate hikes: The Federal Reserve has raised interest rates several times in recent months to combat inflation, which has led to a decline in stock prices. The higher interest rates have made it more expensive for companies to borrow money, which has resulted in a decline in their stock prices.

- COVID-19 pandemic: The ongoing pandemic has had a significant impact on the tech sector, with many companies struggling to adapt to new working arrangements and supply chain disruptions.

Tech Sector's Decline

The tech sector has been the hardest hit by the Nasdaq 100's correction, with many large tech stocks facing significant selling pressure. Some of the key drivers of the decline include:

- Decline in earnings: Many tech companies have seen a decline in earnings due to the impact of the pandemic and rising inflation. This has led to a decline in their stock prices.

- High valuations: The tech sector has historically been characterized by high valuations, which has made it vulnerable to a correction. Many tech stocks are trading at price-to-earnings ratios that are significantly higher than the broader market.

- Regulatory scrutiny: The tech sector has faced increased regulatory scrutiny in recent months, with many companies facing criticism over their handling of user data and competition practices.

Key Players in the Tech Sector

Some of the key players in the tech sector that have been affected by the Nasdaq 100's correction include:

- Apple: Apple's stock price has fallen by over 15% in the past month, leading to concerns about the company's ability to maintain its profit margins.

- Amazon: Amazon's stock price has fallen by over 10% in the past month, leading to concerns about the company's ability to maintain its market share.

- Google: Google's parent company Alphabet has seen its stock price fall by over 10% in the past month, leading to concerns about the company's ability to maintain its profitability.

Implications for the Broader Market

The Nasdaq 100's correction has significant implications for the broader market, including:

- Potential for a broader market correction: The decline in the tech sector has sparked concerns about the potential for a broader market correction. Many investors are reevaluating their investment strategies and seeking to hedge their portfolios.

- Increased volatility: The Nasdaq 100's correction has led to increased volatility in the broader market, with many stocks experiencing significant price swings.

- Shift to value stocks: The decline in the tech sector has led to a shift towards value stocks, with investors seeking to invest in companies with strong balance sheets and competitive advantages.

Expert Analysis

Industry experts have provided some insightful commentary on the Nasdaq 100's correction, including:

- "The Nasdaq 100's correction is a wake-up call for investors, reminding them of the potential for unexpected market movements. We expect to see a shift towards value stocks in the coming months as investors seek to hedge their portfolios."

- "The tech sector's decline is a symptom of a broader market correction. We expect to see a return to more balanced valuations in the coming months, as investors reevaluate their investment strategies."

Top Picks for the Coming Months

Some of the top picks for the coming months include:

- Microsoft: Microsoft's stock price has been relatively stable despite the decline in the tech sector, making it a popular pick among investors.

- Johnson & Johnson: Johnson & Johnson's stock price has been affected by concerns over its opioid lawsuit, but the company's strong balance sheet and competitive advantages make it a attractive pick.

- Procter & Gamble: Procter & Gamble's stock price has been affected by concerns over its consumer trends, but the company's strong balance sheet and diversified portfolio make it a attractive pick.

Conclusion

The Nasdaq 100's correction is a significant development in the stock market, with many investors reevaluating their investment strategies in response. The decline in the tech sector has led to a shift towards value stocks, and many investors are seeking to hedge their portfolios. As the market continues to navigate the complexities of the tech sector, it's essential to stay informed and adapt to changing market conditions.

Loving Auntic Free

Candy Mansoneath

Kate Winsletrome

Article Recommendations

- Kimol Song

- Storage Wars Brandi

- How Many Wayans Brothers Are There

- Millie Bobby Brown

- Meg Nuttd

- Alina Habba Net Worth

- Ben Meiselas Net Worth

- Glenn Medeiros

- Erinlaver

- Jackepp Illness